Stop me if you’ve heard this before: “the reason you’re broke is because you get a latte every morning!!!”

At first glance, their advice might make sense. Let’s look and see how true that is.

A typical cost for a latte, especially in high cost of living (HCOL) areas, is around $5 – could be more, could be less. There are 52 weeks in a year. The average American worker gets 11 days of paid vacation, eight days of sick leave, and 7 days of paid holidays. Combined, this is 26 days of time off, or about 5 weeks.

Many Americans get far less than this, or even won’t use it, but for the purposes of this analysis, let’s assume that’s true. Let’s say that there are 47 working weeks in a year and you want a coffee every single workday.

47 weeks/year * 5 workdays/week * 1 latte/workday = 235 lattes/year.

235 lattes/year * $5/latte = $1,175/year.

$1,175/year is “the reason you’re broke”, apparently. Let’s look at some other expenses.

Transportation Costs

A car in America is practically a necessity. Even in large cities, the public transportation is subpar with long wait times and inconsistent schedules in many places. Using it has a certain negative stigma associated with it. So not only is its use looked down upon, it is extremely impractical and inefficient. So, let’s assume you need a car to function in society – a fair assumption in America.

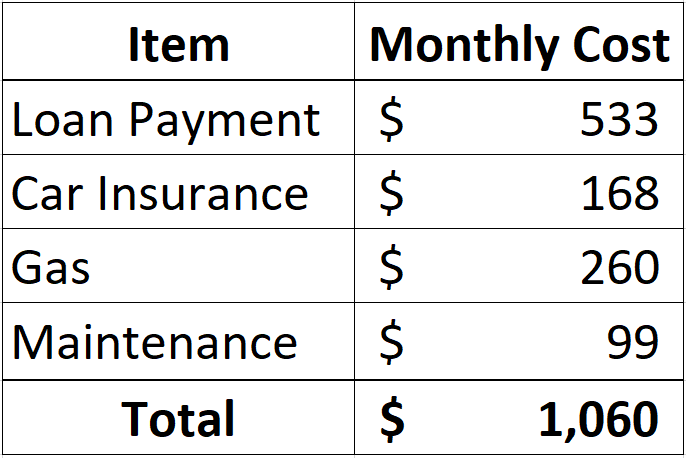

As of late 2023, the average car payment for a used car was $533/month. The average car insurance payment is $168/month. The average fuel cost was $260/month in 2022 (consider the fact the average commute in America is 52 minutes per workday, with it being longer for many people. I myself commuted 90 minutes per day for several years of my life. I do not recommend it.). The average maintenance cost for a new car is $99/month according to AAA in 2017.

Adding all of that up, the average cost of owning a car in America is approximately $1,060/month. That’s $12,720/year. In Latte terms, that’s 2,544 lattes, or almost 11 lattes per workday. Setting aside the crippling caffeine addiction that would require, Lattes are not the real problem here.

It’s no wonder that some Americans drive without car insurance and don’t fix broken windows, mirrors, and other parts on their car. They simply can’t afford it. And the issue isn’t “all of those Lattes they drink”, it’s the fact that a car can cost almost half of many people’s annual wages, but they can’t just not own a car because their job is so far away.

People might then suggest, “find a new job!” Which is easy to say, much harder to do, especially when considering commute times and then getting groceries, picking up and dropping off their kids from school or daycare, cooking, cleaning, and then going to bed. They might have half an hour or even less to relax every day.

The same people that suggest “find a new job!” are often the same people that have the privilege of free time and disposable income.

I’m not saying it’s impossible to find a new job. It’s just very difficult and can be really discouraging and overwhelming.

The point is, small expenses like Lattes are not the thing keeping you or someone else broke. I only gave one example of a major expense, a car, but there’s also rising rent prices, the cost of groceries, medicine, healthcare (for which many people don’t have insurance), student loan debt, credit card debt, and more.

Many people can’t financially (or even in terms of time) afford hobbies, vacations, gifts, celebrations, parties, or eating out.

It’s not because of Lattes.

Through Coins with Clay, I will show you how to make financial changes that actually make a difference. If you want a guide on how to save money on the things that aren’t important to you and spend money on the things that are, check back here soon. I’ll be writing here regularly with actionable advice to improve your financial situation.

See you soon,

Clay

Sources

Photo by pariwat pannium on Unsplash

Average PTO In USA & Other PTO Statistics (2024) – Forbes Advisor

Average Car Payments: What To Expect | Bankrate

What It Costs To Maintain Your Car | Bankrate